Latest

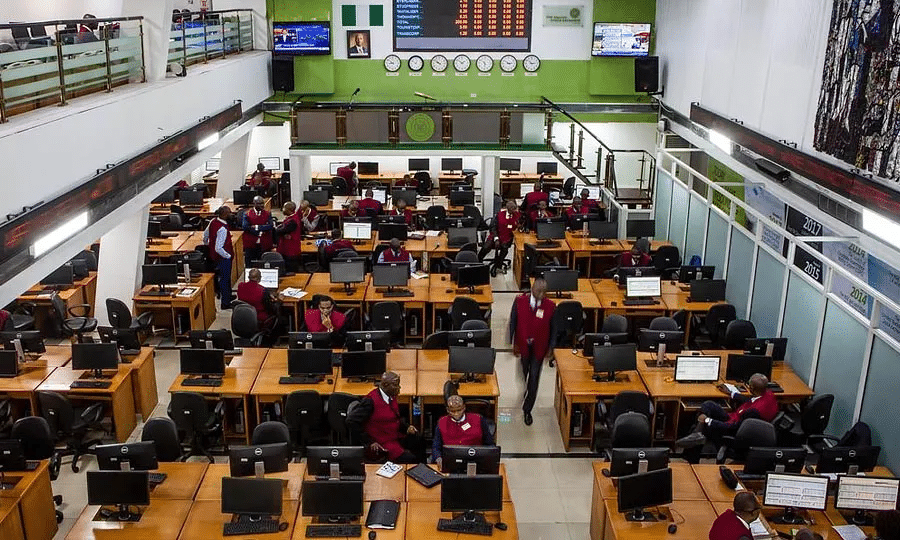

₦1.81 Trillion Boom! Nigerian Stock Market Soars On CBN’s Bold Reforms

Investors in the Nigerian stock market closed September 2025 with impressive gains, pocketing a total of ₦1.811 trillion as confidence surged on the back of the Central Bank of Nigeria’s (CBN) ongoing monetary reforms.....KINDLY READ THE FULL STORY HERE▶

The apex bank’s recent decision to cut the Monetary Policy Rate (MPR) to 27% from 27.5% boosted appetite for equities, driving a shift from fixed-income assets into stocks.

Data from the Nigerian Exchange Limited (NGX) showed that market capitalisation climbed to ₦90.580 trillion in September, up from ₦88.769 trillion in August — a growth of more than ₦1.811 trillion. Likewise, the NGX All Share Index (ASI) advanced by 1.7%, closing the month at 142,710.48 points compared to 140,295.50 points in August.

Market activity was buoyed by renewed buying interest in large-cap stocks after weeks of profit-taking. Traders also positioned themselves ahead of potential market-moving events both locally and globally. On the final trading day of September, the NGX ASI rose by 0.23%, while market capitalisation added ₦445.2 billion.

Top gainers included ARADEL (+9.82%), Fidelity Bank (+5.26%), Nigerian Breweries (+2.38%), and Transcorp (+8.48%). However, market breadth remained negative, with 31 losers outweighing 28 gainers.

Analysts described the rebound as a mix of optimism and caution. According to InvestData Consulting Limited, the market looks set for a cautious continuation of recovery, with key influences expected from inflation trends, exchange rate movements, government policies, global crude oil prices, and international investor risk appetite.

September’s rally highlights investors’ renewed faith in equities as a viable option amid Nigeria’s evolving monetary landscape. Still, analysts warn that the sustainability of the rally will depend heavily on macroeconomic stability and consistent policy direction.